For most users, invoicing customers, getting paid, and paying their bills is most important. Reports help make sense of all the numbers. You or your accountant can use them so that Tax Returns (or any other end-of-year returns) can be completed more quickly.

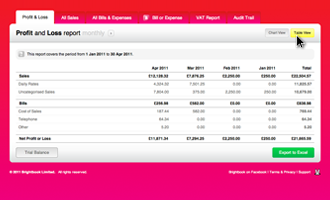

The Profit and Loss report (or financial statement) is a summary of your sales, costs and bills/expenses during a specific period of time. Usually this is over a quarter or a year, in Brightbook you can also review the previous month, in weeks.

The report shows you how much money (Profit) you end up with once you subtract your costs (bills and expenses) from your sales.

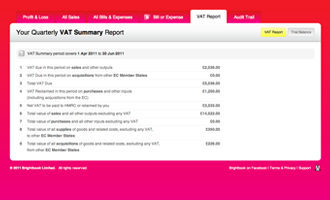

A report showing you what you paid tax on, how much you paid and how much you can reclaim from the Taxman.